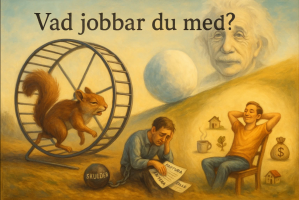

Enligt min mening är den största missuppfattningen om marknaden att idén att om man köper och behåller aktier under lång tid så kommer man alltid att tjäna pengar.

Låt mig ge några konkreta exempel.

Den som köpte aktiemarknaden vid vilken tidpunkt som helst mellan botten 1896 och botten 1932 skulle ha förlorat pengar.

Med andra ord: det finns en 36-årsperiod där en köp-och-behåll-strategi skulle ha lett till förluster.

Ett mer modernt exempel är att den som köpte marknaden någon gång mellan botten 1962 och botten 1974 också skulle ha förlorat pengar.

(Se grafer här!)

In my opinion, the greatest misconception about the market is the idea that if you buy and hold stocks for long periods of time, you'll always make money. Let me give you some specific examples. Anyone who bought the stock market at any time between the 1896 low and the 1932 low would have lost money. In other words, there's a 36 year period in which a buy-and-hold strategy would have lost money. As a more modern example, anyone who bought the market at any time between the 1962 low and the 1974 low would have lost money.

Victor Sperandeo

Fler visdomsord finner du här!

Tidigare artiklar på Börstjänaren:

Tidigare artiklar på Börstjänaren:| 2025-06-12 | Stopp som fungerar – inte bara känns bra |

| 2025-06-06 | Vad styr egentligen marknaden? |

| 2025-05-31 | Acceptera förlusten |

| 2025-05-23 | Vet var du kliver ur – innan du kliver in |

| 2025-05-22 | Rätt eller fel? Det är inte poängen |

| 2025-05-16 | Hellre orolig än fattig |

| 2025-05-15 | De flesta vet inte vad de gör |

| 2025-05-09 | Regler räcker inte – disciplin avgör allt |

| 2025-05-09 | Eviga misstag – tidlös spekulation |

| 2025-05-04 | Noggrannhet |

| 2025-05-04 | Köpa och behålla aktier? |

| 2025-04-25 | Många "gurus" är misslyckanden |

| 2025-04-25 | Steve Lescarbeau om studier |

| 2025-04-09 | Graham om risk |

| 2025-04-04 | John Bender - inga gränser |

| 2025-02-08 | Peter Lynch |

| 2025-02-07 | Små spekulanter... |

| 2025-01-18 | George Soros om oförutsägbara marknader |

| 2025-01-18 | Gustave le Bon the crowd |

| 2025-01-17 | Stanley Druckenmiller om stora vinster |